What The Tariffs Mean Right Now!

Updated Weekly

Last updated: August 6, 2025

- August 4: CBP issued official HTS codes and exemptions for Brazilian imports subject to a new 40% duty starting August 6, clarifying that goods already in transit may be exempt if entered before October 5.

- August 1-4: USTR Greer said some tariff deals are finalized but may be rejected by President Trump, and confirmed that reciprical tariffs on over 70 countries will rise August 7, pushing U.S. average rates to a historic 18.3%

- July 31: U.S. reciprocal tariff rates are further modified, with duties ranging from 15% to 41% based on trade deficits, effective August 7, 2025

- July 31: The duty on Canadadian products increases from 25% to 35%, effective August 1, 2025, due to concerns over illicit drug trafficking

- July 31: The tariff increase on Mexican goods is avoided, with current terms extened for 90 days as the U.S. and Mexico work on a long-term trade agreement

- July 30: U.S. declares a national emergency over actions by Brazil; imposes a 50% tariff on specified Brazilian imports under the IEEPA

- July 30: White house issues proclamation under Section 232 imposing a 50% tariff on semi-finished copper imports, effective August 1, 2025; refined copper may face additional duties of 15% in 2027 and 30% in 2028, pending Commerce Department review by June 30, 2026

- July 30: Executive Order suspends global duty-free “de minimis” exemption (under $800), effective August 29, 2025; postal shipments will initially incur flat-rate duties($80-200), shifting to standard ad valorem tariffs after six months

- July 29: U.S. and EU announce historic trade deal with a 15% tariff ceiling on most EU goods and major investment commitments, effective August1.

- July 23: U.S. – Japan Strategic Trade & Investment Agreement announced.

- July 22: U.S. – Indonesia deal sets mutual tariff rate at 19%

- July 7: Reciprocal tariffs raised to 50% (UK exempt)

- June 4: Steel & Aluminum tariffs raised to 50% (UK exempt)

- May 2: De minimis exemption for China/HK removed

- April 5: “Liberation Day” 10% baseline tariff in effect

SOURCE: https://www.whitehouse.gov/news/

Updated Weekly

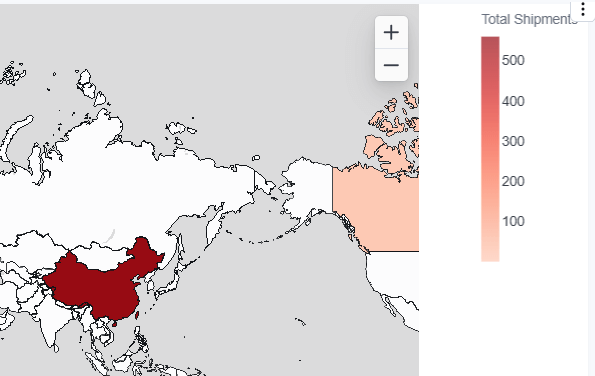

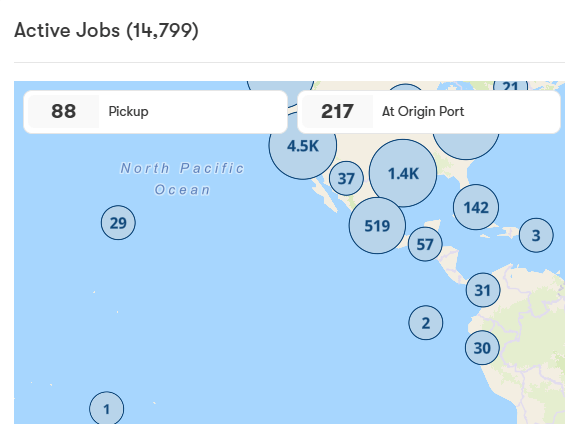

See How Tariffs Impact Your Shipments

Want to Know EXACTLY Which Tariffs are Impacting Your Business?

Your TrakIt dashboard includes the latest trade data, personalized to your shipments. You don’t have to guess. You can know.

Customers can login below. Don’t have an account but want to learn how you can get indepth insights? Request a demo below!

Already Using TrakIt?

Explore your personalized tariff impact dashboard. Your shipment-level exposure, costs, and mitigation tools are waiting.

Not Using TrakIt Yet?

Want to see what Trakit can do for your team? TrakIt helps importers and exporters:

- See tariff exposure

- Monitor landed cost fluctuation

- Predict and mitigate risks

- Make smarter decisions

Get the Latest News Directly To Your Inbox!

LOGISTEED America sends out weekly Newsletters updating you about what is happening in the logistics world and what could be affecting your cargo! Stay up to date with the latest by signing up for our newsletter.

See this week’s Industry Newsletter

See the latest Customer Advisory

Resource Page FAQs

A. We post updates every week, with urgent news shared as needed. Bookmark this page and check back regularly. Subscribe to our Industry Newsletter to receive updates directly to your inbox.

A. Please reach out to your LOGISTEED account representative or contact your local LOGISTEED America branch to talk with a customs brokerage expert.

A. We are actively helping clients identify possible alternate routing options and discussing ongoing strategies to help them build their businesses, your success, is our success. Let’s talk strategy.

Need Help Now?

We’re here to support you. Contact your representative today.

Downloadable Resources

Need more details? Download our quick resources below.

- Get to know LOGISTEED America with our company one-pager

- LOGISTEED America ACE ACH PMS Overview Flyer

- LOGISTEED America ACH Overview Flyer

- LOGISTEED America PMS Overview Flyer

DISCLAIMER

The information provided on this page is for general informational purposes only and is provided as a convenience to our customers. While LOGISTEED America strives to ensure the accuracy and timeliness of the content, we make no guarantees, representations, or warranties, express or implied, as to the completeness, reliability, or accuracy of the information.

LOGISTEED America shall not be held liable for any errors or omissions, or for any loss or damage resulting from reliance on this information. Users are strongly encouraged to consult with legal counsel, trade attorneys, or professional compliance consultants before making any decisions that may affect their business operations.